This is the money Bob can use for covering fixed costs, like the rent for his bakery or his snazzy new bagel-making machine. Contribution margins are sometimes confused with profit margins because both measure profitability. can you cancel a po sent to a supplier However, contribution margin removes variable costs from the result, leaving only the amount of revenue available for fixed expenses. Contribution margin explains how growth in sales can affect growth in profits.

How to calculate contribution margin

- Conceptually, the contribution margin ratio reveals essential information about a manager’s ability to control costs.

- They immerse themselves in historical data, searching for patterns that reveal how costs have responded to activity changes in the past.

- Think of it as the total cash you’d have if you sold every single glass of that delicious lemonade at your stand.

- Evangelina Petrakis, 21, was in high school when she posted on social media for fun — then realized a business opportunity.

- In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement.

Over more than a decade of finance experience, Mike has added tens of millions of dollars to businesses from the Fortune 100 to startups and from Entertainment to Telecom. Mike received his Bachelor of Science in Finance and a Master of International Business from the University of Florida, laying a solid foundation for his career in finance and accounting. The following are the disadvantages of the contribution margin analysis.

How confident are you in your long term financial plan?

The contribution margin ratio is calculated as (Revenue – Variable Costs) / Revenue. Very low or negative contribution margin values indicate economically nonviable products whose manufacturing and sales eat up a large portion of the revenues. Alternatively, the company can also try finding ways to improve revenues. For example, they can simply increase the price of their products. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May.

Ask Any Financial Question

It is important for you to understand the concept of contribution margin. This is because the contribution margin ratio indicates the extent to which your business can cover its fixed costs. Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered.

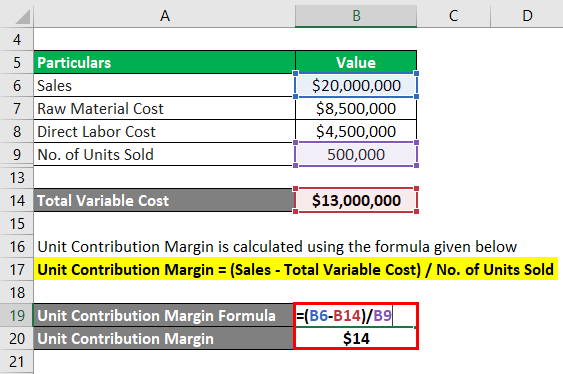

When calculating the contribution margin, you only count the variable costs it takes to make a product. Gross profit margin includes all the costs you incur to make a sale, including both the variable costs and the fixed costs, like the cost of machinery or equipment. Once you have calculated the total variable cost, the next step is to calculate the contribution margin. The contribution margin is the difference between total sales revenue and the variable cost of producing a given level of output.

Is contribution margin the same as profit?

Let us try to understand the concept with a contribution margin example. If you work in finance or accounting and want to save time, avoid mistakes, and impress your boss, then you have come to the right place. I’ll help automate your work and unstick your career with straightforward guides and case studies. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

So, it is an important financial ratio to examine the effectiveness of your business operations. Now, this situation can change when your level of production increases. As mentioned above, the per unit variable cost decreases with the increase in the level of production.

This revenue number can easily be found on the income statement. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement. A contribution margin analysis can be done for an entire company, single departments, a product line, or even a single unit by following a simple formula. The contribution margin can be presented in dollars or as a percentage.